- David Tepper of Appaloosa Management pivots from Amazon to Nvidia, emphasizing the potential of AI technology.

- Nvidia’s growth is driven by a demand for AI chips, appealing to major players like Meta Platforms.

- Bill Gates strategically reduces Microsoft investments to focus on McDonald’s, known for its stability and global expansion plans.

- McDonald’s resilience is underscored by its focus on value menus and franchise royalties.

- The financial landscape requires adaptability, as demonstrated by Tepper and Gates, with a focus on emerging opportunities and stable performers.

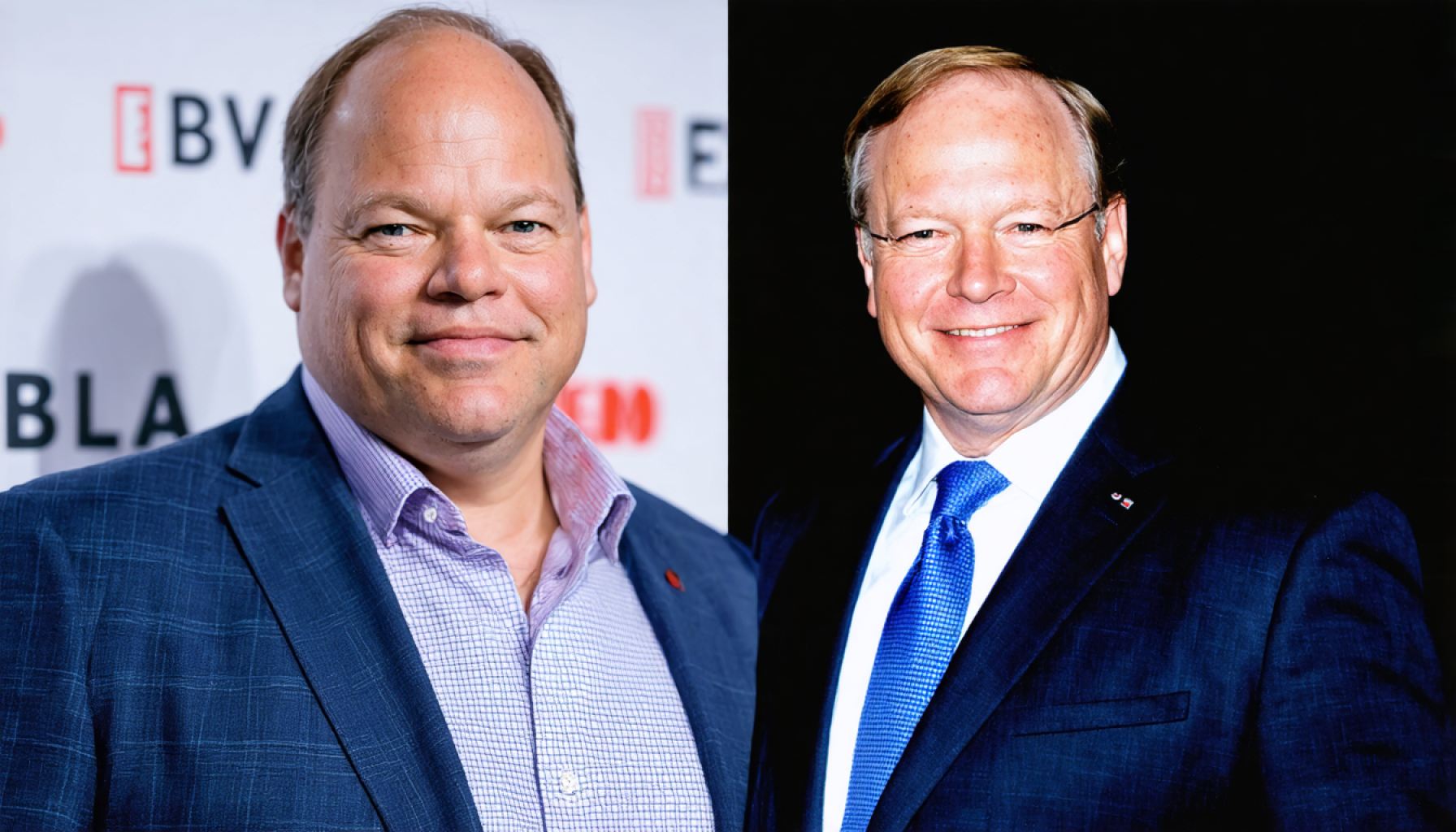

In the corridors of finance, strategic moves echo loudly. This narrative unfolds with two titans of industry—David Tepper of Appaloosa Management and Bill Gates of the Gates Foundation—who are deftly shuffling the deck of their vast investments.

The calm, measured exterior of Tepper belies a decisive shift from Amazon to Nvidia. Tepper’s reduction of Amazon shares, despite its robust cloud services growth, signals a keen eye on Nvidia’s burgeoning potential in AI technology. As demand for advanced AI chips accelerates, Nvidia’s data center revenue soars, painting a future tinged with opportunity. Even while innovations from China’s DeepSeek momentarily cast shadows over Nvidia’s growth narrative, the consistent investment in AI by giants like Meta Platforms buoys the market. With a strategic long game in mind, Tepper appears to favor Nvidia’s momentum over Amazon’s stable ascent.

On another front, Gates, a maestro of the tech world, recalibrates his investment symphony. Despite Microsoft’s towering presence within the Gates Foundation, Gates prudently trims his holdings, diverting attention to the fast-food behemoth McDonald’s. Known for its resilience across economic tumult, McDonald’s emerges as a compelling player, poised for expansion with plans to open thousands of new restaurants worldwide. The Golden Arches deftly weather past storms, their profits fortified by an aggressive push on value menus and franchise royalties.

For the average investor, the takeaway is clear: adaptability in investment can yield promising returns. Tepper and Gates illustrate that even stalwarts like Microsoft and Amazon can make way for fresh prospects. In a landscape as dynamic as today’s market, recognizing potential in emerging trends while securing steady performers is not just advice—it’s an art form in financial agility.

Why These Finance Gurus Are Betting on Nvidia and McDonald’s: Insider Insights

How-To Steps & Life Hacks

1. Conduct Thorough Research: Before making investment decisions, delve into company reports, industry trends, and expert analyses to identify promising opportunities like AI technology in Nvidia.

2. Diversify Investments: Allocate resources across sectors to minimize risk. Tepper’s investment in AI and Gates’ in fast food illustrate the reward of diversification.

3. Stay Abreast of Economic Trends: Keep informed about global economic trends and shifts, which can signal when to adjust holdings or explore new sectors.

4. Be Adaptable: Adapt strategies based on new information, as showcased by these investors shifting from traditional strongholds to emerging sectors.

Real-World Use Cases

– Nvidia in AI: Nvidia’s GPUs and AI solutions are pivotal in technological advancements, making them essential for AI-driven enterprises and data centers.

– McDonald’s Expansion: With plans for extensive global expansion, investing in McDonald’s can be seen as betting on a model that thrives both in emerging and stable markets.

Market Forecasts & Industry Trends

– AI Chip Market Growth: The AI chip market is projected to grow at a CAGR of 45% or more, driven by demand for data-intensive applications, as detailed in Gartner reports.

– Fast Food Resilience: Fast food retains stability even during economic downturns. Analysts predict a steady growth rate as companies like McDonald’s innovate their offerings and expand locations.

Reviews & Comparisons

– Nvidia vs. Amazon: While both companies have solid growth potential, Nvidia’s focus on niche AI and data solutions gives it a technological edge in innovative sectors.

– McDonald’s vs. Other Fast-Food Chains: McDonald’s outpaces rivals like Burger King and Wendy’s in global reach and adaptability, highlighted by its efficient franchise model.

Controversies & Limitations

– Supply Chain Concerns: Nvidia’s reliance on advanced chip manufacturing could be impacted by geopolitical tensions, potentially affecting supply chains.

– Health Criticisms: McDonald’s faces criticism related to health impacts, which could influence public perception and regulatory pressures.

Features, Specs & Pricing

– Nvidia’s Product Line: Includes powerful GPUs and AI platforms essential for deep learning applications, detailed on Nvidia’s official site.

– McDonald’s Pricing Strategy: Focuses on competitive pricing through value menus, ensuring affordability while maximizing profit margins.

Security & Sustainability

– AI Security: Nvidia emphasizes cybersecurity innovations in AI applications, essential for safeguarding data-heavy operations.

– Sustainability Efforts: McDonald’s is investing in sustainable packaging and energy-efficient restaurants to mitigate environmental impact.

Insights & Predictions

1. Long-Term AI Growth: Nvidia’s integration into emerging AI trends is expected to bolster its market standing in the coming years.

2. Steady Consumer Demand: McDonald’s expansion plans suggest strong potential for returns owing to consistent consumer demand for convenient dining options.

Tutorials & Compatibility

– Getting Started with AI Investing: Utilize investment platforms like Bloomberg for tutorials and guides on entering the AI investment space.

– Franchise Opportunities: Explore McDonald’s franchise opportunities and training programs to understand compatibility and profitability.

Pros & Cons Overview

– Nvidia: Offers significant growth in AI tech but may face challenges from emerging competitors.

– McDonald’s: Strong market presence and resilience, albeit subjected to health and regulatory challenges.

Actionable Recommendations

1. Leverage FinTech Platforms: Use platforms like Robinhood for comprehensive data on trending stocks and direct investment options.

2. Monitor Industry Reports: Stay updated with industry-specific reports and analyses to anticipate market shifts efficiently.

3. Balance Risk and Reward: Strategically balancing high-growth potential stocks like Nvidia with stable, reliable options like McDonald’s can enhance portfolio robustness.

By taking cues from these strategic moves, even the average investor can effectively navigate the complex financial landscape, combining foresight with agility for optimal returns.